I have always wanted to create a passive income source. It has been one of my financial bucket list items for quite a while. Having more than one income source is a very good thing to have. The way I like to visualise it is. Imagine that your life is a table top. An income source acts as a leg to that table top. Most people only have one income source ie their main job. So there life is supported by only one leg. Whereas if you added a source of passive income you now have to legs supporting you. This gives you more security in life, as you can loose you main job but your are still supported income wise. Most rich people have multiple sources of passive income supporting them.

What is a passive income source

A passive source of income is one in which you do not need to use you physical time to create money. So where as normal job you go to say a shop work for eight hours then go home. This is a active source of income. Your time is exchanged for money in return. A passive source of income is the opposite of this. They do require a little bit of setting up to begin with, but one set up they do not require you time to bring in a income. Passive income is the best sort of income as it frees up your time to pursue other activities. For me that would be travelling and seeing the world.

Create a passive income source

My first source of income was capital gains on investments in stocks and shares. Buying stocks and shares is one of the easiest and least expensive ways to create a passive source of income. Whereas with say a rental source of income on property with its high cost of entry. With stocks and shares you can start with a couple of hundred pounds/dollars.

Over the years I have been adding to my stocks and shares portfolio. That along with capital gains on those that I already held begins to add up to quite a reasonable income. Most of my portfolio is in ETFs (exchange traded funds) which are a fund of shares grouped together. These allow to good diversification so hopefully risk of loss is diminished.

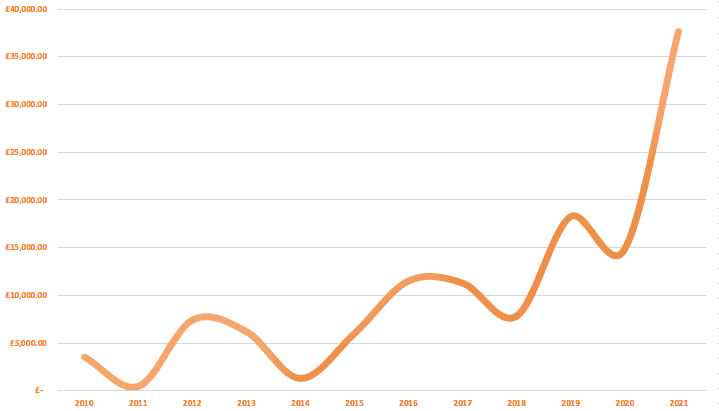

For 2022 the capital gains on my stocks and share investments was £37,614($49,331) this for me is a very good amount of income. Especially as it is a purely passive source of income. This amount is actually above the average UK salary for 2021 which was £25,971.

I have been tracking this source of passive income for several years now. You can see how it has grown since 2010 when I first invested in stocks and shares.

How my investments are structured

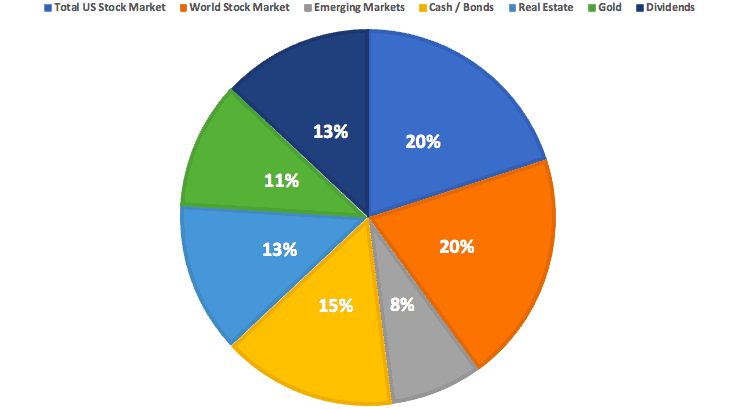

This is how I personally have my investments structured. I prefer to have a very diverse portfolio to help reduce the risk of losses on individual companies. The potential gains will not be as great compared to a portfolio of just a few companies. But the risk is greatly reduced compared a portfolio with just a few positions.

My portfolio is spit into seven areas. US stock market, All world stocks, Emerging Markets, Real Estate, Gold, Dividend focused, Cash/Bonds.

Brokers

There are quite a few brokers with who you could invest with in the UK. I will list a few of them below.

For people just starting out I would tend to pick a broker that has low platform fees, low transaction fees and also lets you buy fractions of shares.

For bigger accounts I would prefer to go with one of the more well established brokers.